ad valorem tax florida exemption

An ad valorem tax is based on the assessed value of an item such as real estate or personal property. If a Florida Property Tax Appraiser denies your longstanding ad valorem tax exemption you may be able to get it back by challenging the denial in front of.

Florida Homestead Exemption How It Works Kin Insurance

What is ad valorem tax exemption Florida.

. Section 164 of the revenue code specifies deductible taxes. The exemption may remain in effect. Homestead Ad Valorem Tax Exemption For Deployed Military Personnel.

Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect to business improvements such as a new building building expansion or new equipment purchased in connection with. HOMES AND HOMES FOR SPECIAL SERVICES. 2 a 3 cap on the annual increase in the ad valorem tax value of the home.

Ad valorem tax exemptions are available in Florida for projects i wholly owned by a nonprofit entity that is a corporation not-for-profit or its wholly owned subsidiary qualified as charitable under Section 501c3 of the Internal Revenue Code and in compliance with other requirements the nonprofit exemption under Florida Statutes Section 19619781 and used. The greater the value the higher the assessment. Economic Development Ad Valorem Tax Exemption.

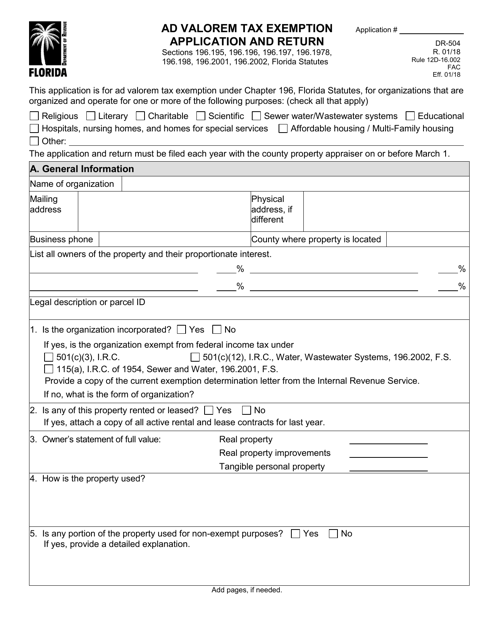

When to file for Exemptions Florida Statute 196011 Your initial application for all exemptions must be made in person by March 1st of the assessment. Ad Valorem Tax Exemption Application and Return Not-For-Profit. AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR EDUCATIONAL PROPERTY.

INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION. When a private party purchases the fee interest in public land however the lands immunity or exemption by virtue of public ownership is lost and the land becomes taxable unless exempt under some other provision of law. Members or former members of any branch of the United.

PO Box 4097. What is ad valorem tax exemption Florida. Taxes usually increase along with the assessments subject to certain exemptions.

Santa Rosa County property taxes provide the fund local governments to provide needed services such as education law. The Florida Legislature enacted implementing legislation FLORIDA STATUTE 196173 whichprovides an additional homestead property tax exemption for members of the US. The Ad-Valorem Tax Exemption is an incentive that is provided by state and county law that is intended to encourage the rehabilitation and maintenance of historic structures.

This application is used by owners of certain educational institutions to apply for an ad valorem tax exemption for property used exclusively for educational purposes as provided in section s 196198 Florida Statutes FS by select one. What is an ad valorem tax in Florida. 3 portability of an under-assessment the amount by which the.

Service members who receive homestead exemption may be entitled to an additional ad valorem tax exemption on their homestead property. In Florida property taxes and real estate taxes are also known as ad valorem taxes. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Bldg 7 Suite 717. The program enables Pinellas County to more effectively stimulate job creation. VII State Const requiring a just valuation of all property for ad valorem taxation and s.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. This application is for use by nonprofit organizations to apply for an ad valorem tax exemption for property. Fort Walton Beach FL 32547-5068.

1170 Martin Luther King Jr Blvd. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect to business improvements. Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now.

Taxes usually increase along with the assessments subject to certain exemptions. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year.

This local program is authorized by Section 1961997 Florida Statutes and allows counties and municipalities to adopt ordinances allowing a property tax exemption for up to 100 of the increase in assessed improvements resulting from an approved rehabilitation of a qualified historic property. 1 The board of county commissioners of any county or the governing authority of any municipality may adopt an ordinance to allow ad valorem tax exemptions under s. Ad Valorem Tax.

One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. The most common ad valorem taxes are property taxes levied on real estate. In the case of ad valorem taxes taxpayers can deduct property taxes on their income tax returns but non-ad valorem taxes.

One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. Ad valorem means based on value. Subscribe to Our Newsletter Subscribe Location.

The economic development ad valorem tax exemption program is designed to help existing businesses expand and encourage industries that offer higher-than-average salaries to locate here. The 2021 Florida Statutes. Ad-Valorem Tax Exemption - Miami-Dade County.

Florida Administrative Code. Military or military reserves the United States Coast Guard or its reserves who receive a homestead exemption. The leasehold interests owned by Fernandina Beach and leased to private aircraft owners are exempt from ad valorem taxation under section 1961992a Florida Statutes 2018 so long as the lessees are using the leaseholds for a noncommercial aviation or airport purpose or operation with no engagement in for-profit activity.

AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR CHARITABLE RELIGIOUS SCIENTIFIC LITERARY ORGANIZATIONS HOSPITALS NURSING. 196199 Government property exemption. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect to business improvements such as a new building building expansion or new equipment purchased in connection with.

A permanent resident of Florida that owns his or her principal residence in Florida qualifies for 1 a 50000 exemption and an additional 50000 exemption if the owner is age 65 or older from the value of the property for ad valorem tax purposes. Sections 196195 196196 and 196197 Florida Statutes. Furthermore the court upheld the exemption because the discontinuance of the services provided by the Chamber of Commerce could result in the allocation of public funds for those services.

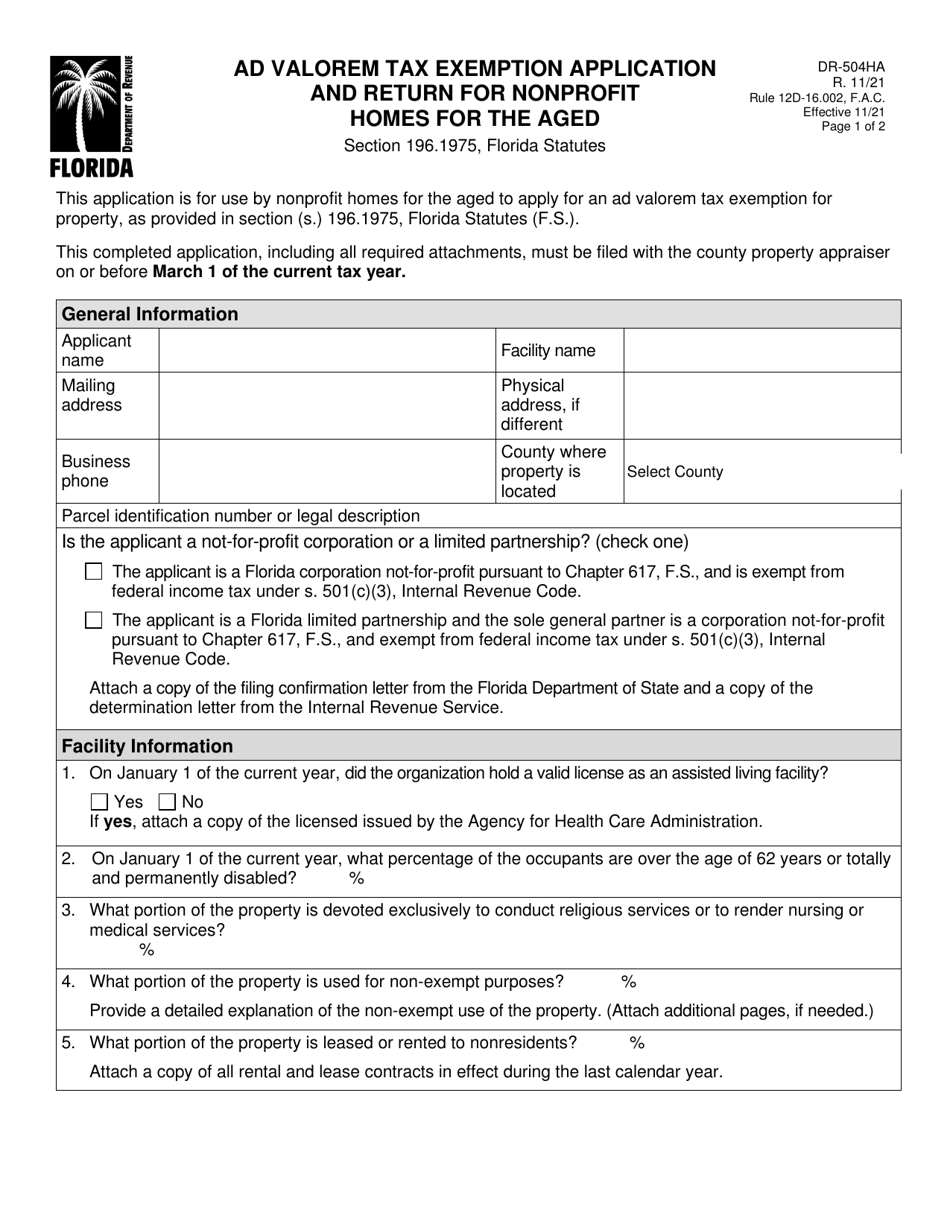

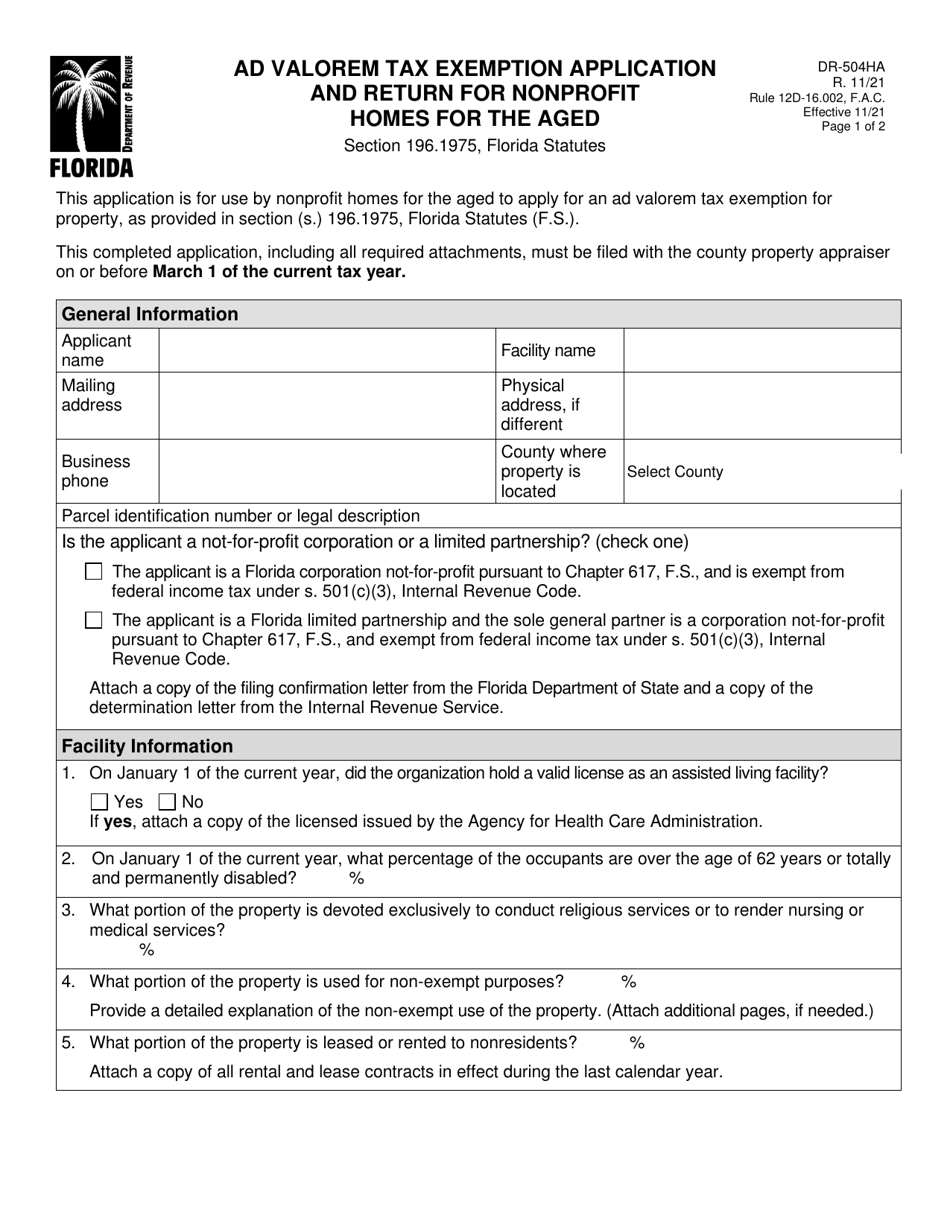

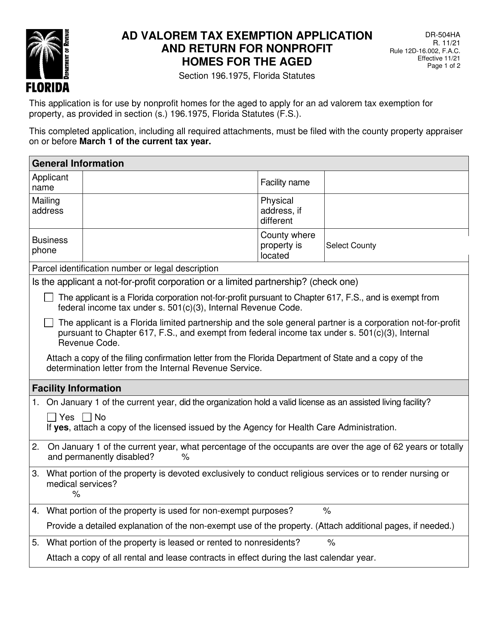

Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. Ad Fill Sign Email FL DR-504 More Fillable Forms Register and Subscribe Now. HOMES FOR THE AGED.

196198 1962001 1962002 Florida Statutes This application is for ad valorem tax exemption under Chapter 196 Florida Statutes for organizations that are organized and operate for one or more of the following purposes. Save Time Signing Documents from Any Device. Property Tax Exemption for Historic Properties.

Check all that apply. Can ad valorem taxes be deducted. All property of the United States is exempt from ad valorem taxation except such property as is subject to tax by this state or any political subdivision thereof or any.

VII of the State Constitution to historic properties if the owners are engaging in the. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect. Florida Statutes 1961997 Ad valorem tax exemptions for historic properties.

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

Explaining The Tax Bill For Copb

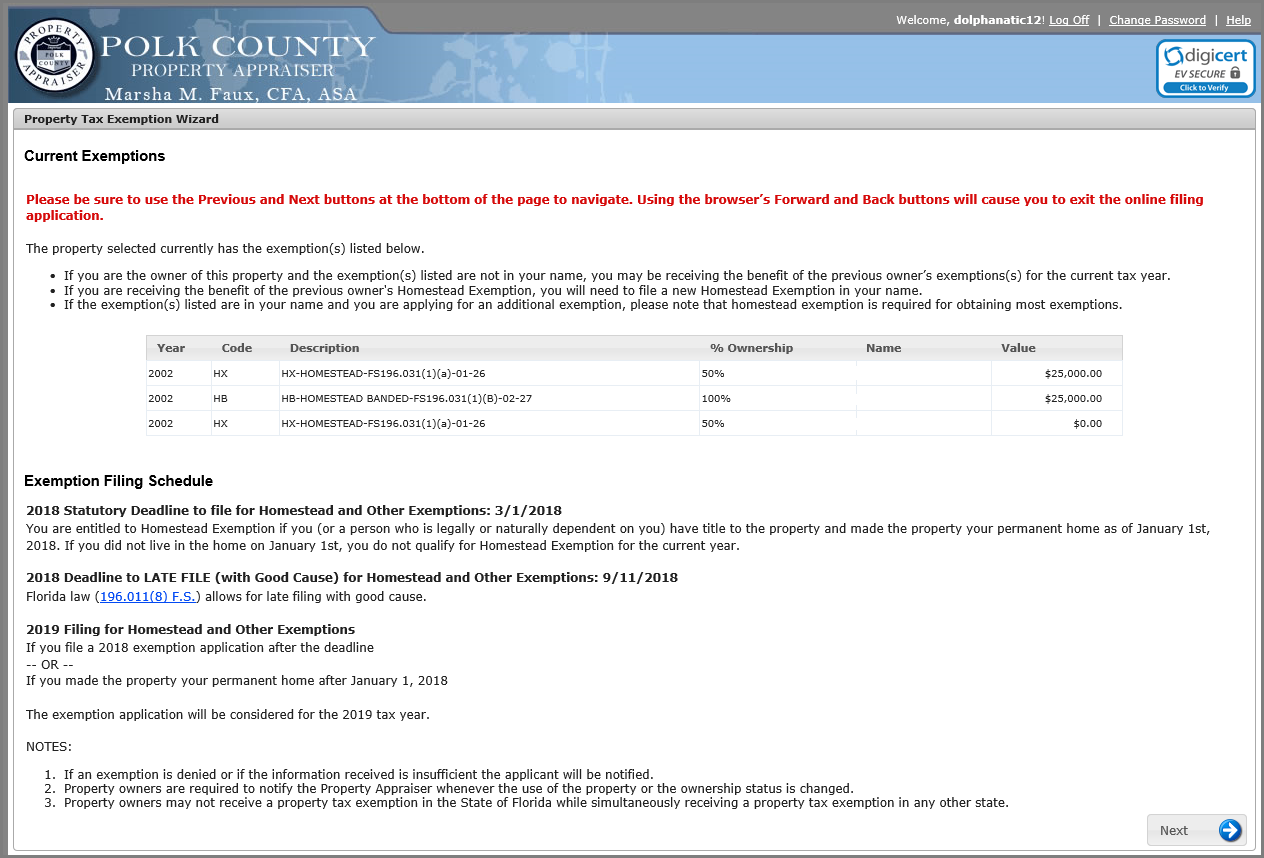

Form Dr 504ha Fillable Ad Valorem Tax Exemption Application And Return Homes For The Aged N 11 01

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

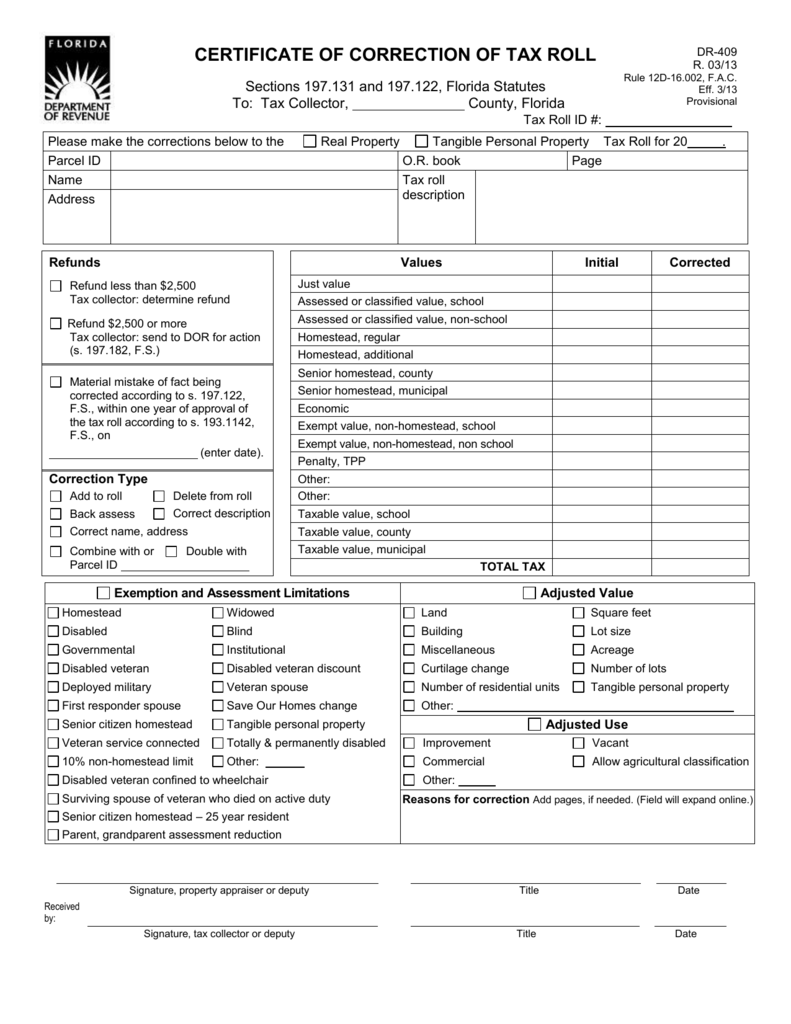

Certificate Of Correction Of Tax Roll

Real Estate Taxes City Of Palm Coast Florida

Understanding Your Tax Bill Seminole County Tax Collector

Exemptions Hardee County Property Appraiser

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged Florida Templateroller

What Is A Homestead Exemption And How Does It Work Lendingtree

Form Dr 501 Florida Department Of Revenue

How To File For The Homestead Tax Exemption Property Tax Tallahassee

Homestead Exemption Attorney Miami Martindale Com

Form Dr 504 Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return Florida Templateroller

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged Florida Templateroller