extended child tax credit calculator

The maximum child tax credit amount will decrease in 2022. Your amount changes based on the age of your children.

Child Tax Credit This Calculator Shows How Much You Ll Earn

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of.

. Have been a US. Tax Changes and Key Amounts for the 2022 Tax Year. The tool below is to only be used to help.

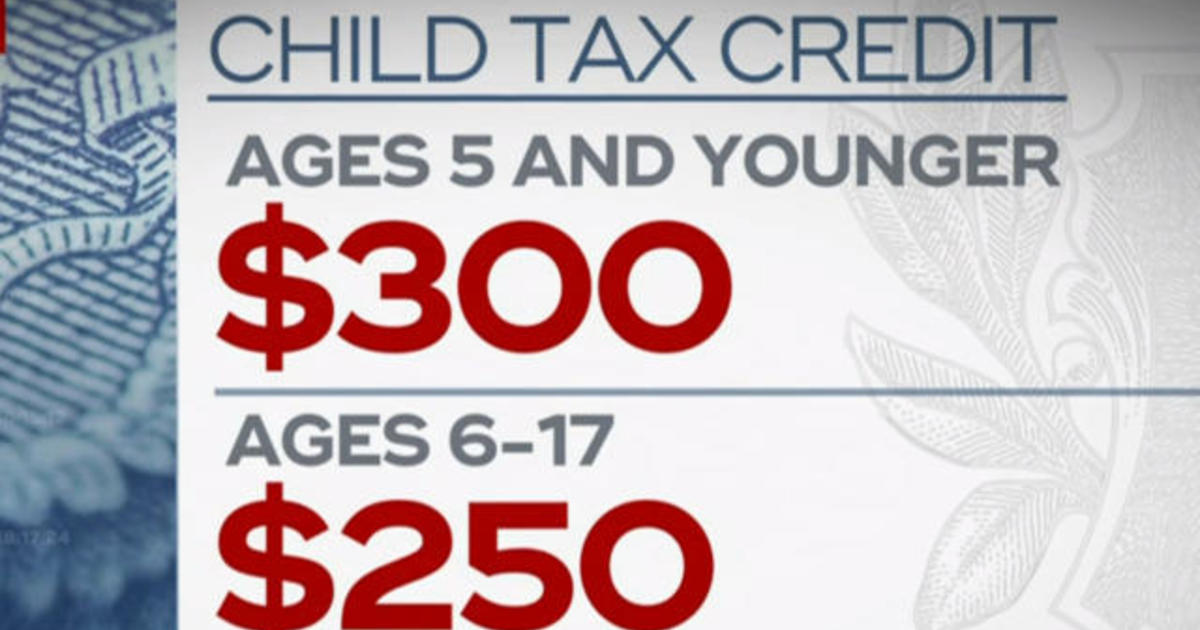

The American Rescue Plan Act of 2021 has upped the child tax credit substantially -- as high as 3600 per child ages 5 and under for qualifying people. As part of the American Rescue Act signed into law by President Joe Biden in. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if.

For married couples and joint filers the credit will dip below. If your MAGI is 150000 or under you will receive 3600 per child under 6 and 3000 per child age 6-17. Here is some important information to understand about this years Child Tax Credit.

Our child tax credit calculator will help you estimate your refundable child. To qualify a child must have been under age 17 ie 16 years old or younger at the end of the tax year for which you claim the credit2. Ages five and younger is up to.

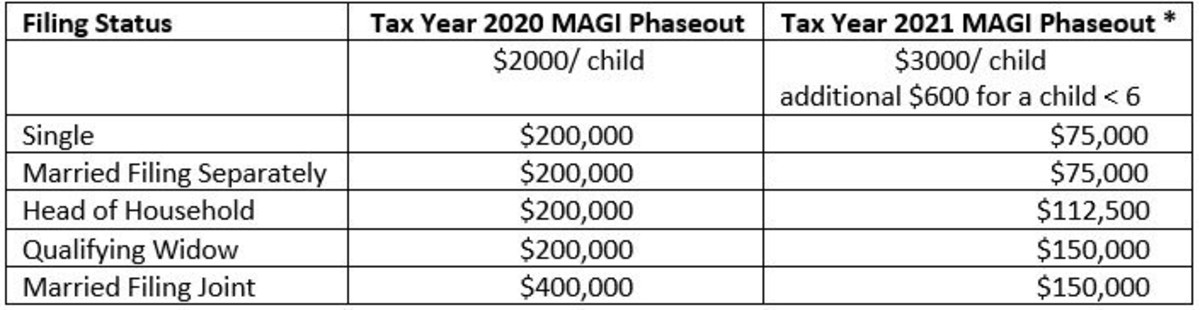

March 8 2022 227 PM 3 min readOne of the big changes this tax season was the temporary expansion of the Child Tax Credit that broadened the benefit in three key ways that helped. Parents with higher incomes also have two phase-out schemes to worry about for 2021. If your MAGI is over 75000 the.

The Child Tax Credit provides money to support American families. The payment for children. Partial Expanded Child Tax Credit.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual. The first one applies to. For instance if you are filing for a single return and your.

The American Rescue Plan Act of 2021 has upped the child tax credit substantially as high as 3600 per child ages 5 and under for qualifying people. In 2022 US expats are eligible to receive between 1400 up to 3600 per qualifying child on their 2021 US Tax Return. The increased child tax credit is reduced by 50 for every 1000 income above the thresholds.

Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. Child Tax Credit amounts will be different for each family. The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021.

The Child Tax Credit will begin to be reduced below 2000 per child if an individual reports an income of 200000.

2021 Child Tax Credit Payment Calculator Smartasset

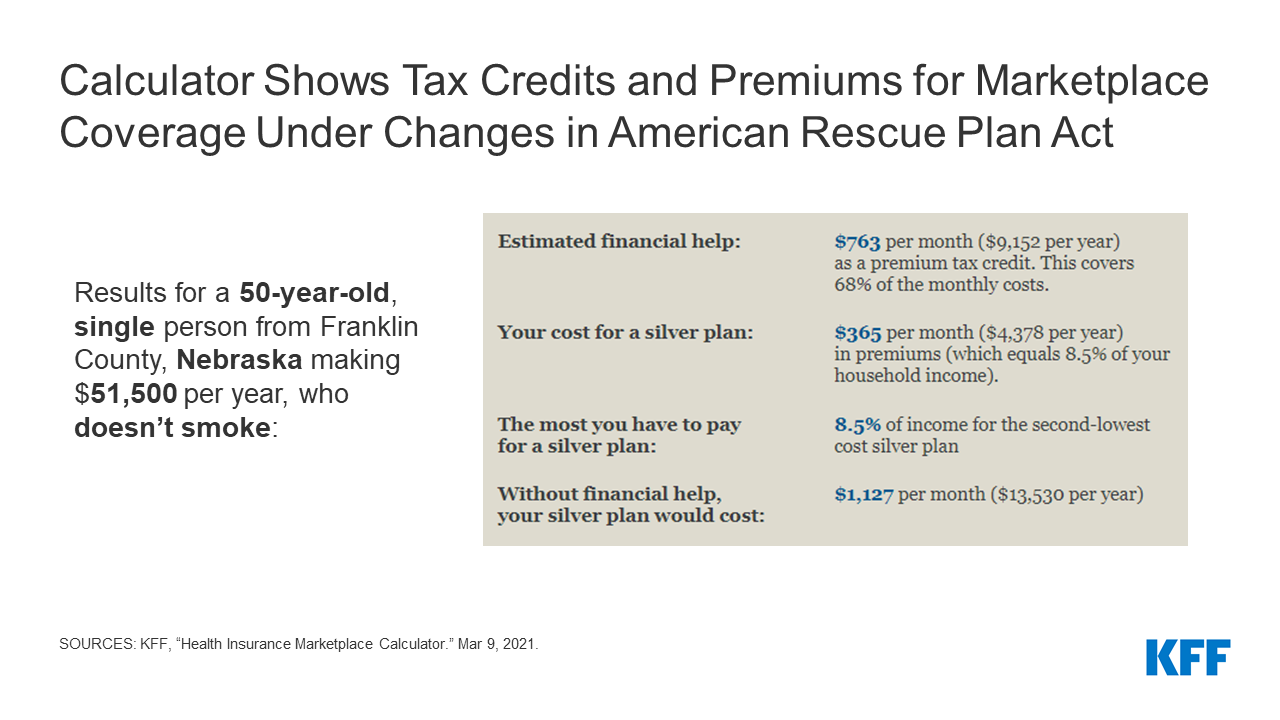

Updated Kff Calculator Estimates Marketplace Premiums To Reflect Expanded Tax Credits In Covid 19 Relief Legislation Kff

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

How To Claim The Child Tax Credit If You Didn T Work In 2021 Wcnc Com

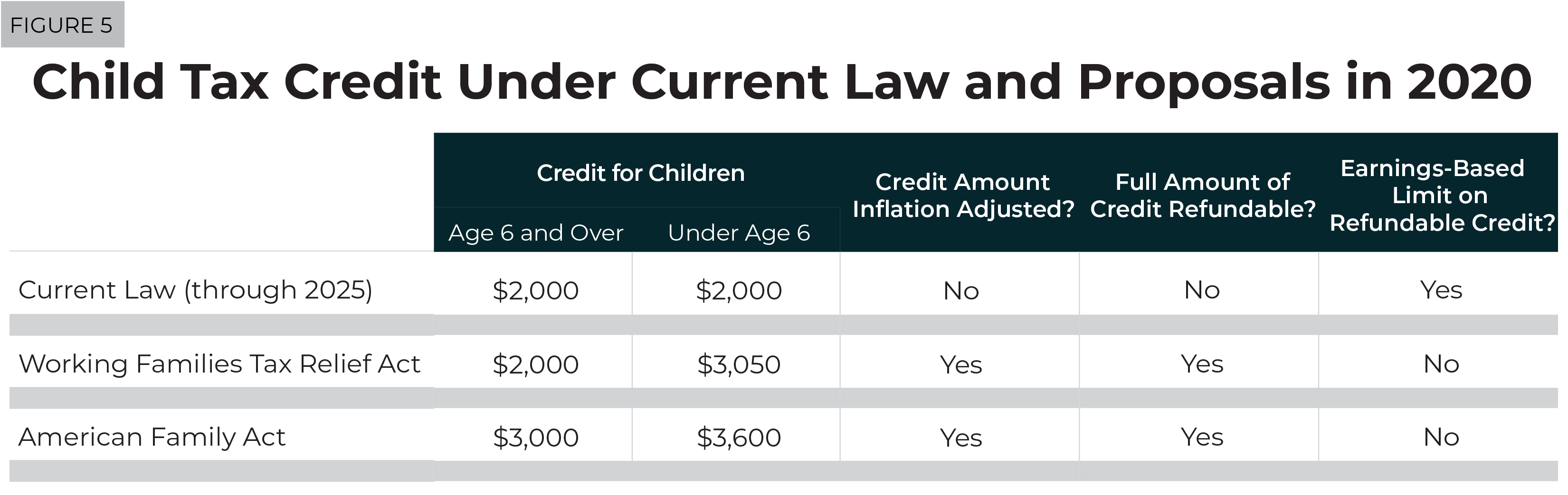

Understanding Five Major Federal Tax Credit Proposals Itep

Child Tax Credit 2021 Website To Help You Claim 2nd Half Of Credit Is Live

What Is The Child Tax Credit And How Much Of It Is Refundable

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

2021 Calculator Before Covid 19 Relief Kff

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

What Build Back Better Means For Families In Every State Third Way

Try The Child Tax Credit Calculator For 2022 2023

What Is The Child Tax Credit Tax Policy Center

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

3600 3000 Child Tax Credit Calculator How Much Will I Receive Per Child As Usa

American Rescue Plan Act Of 2021 And Divorce Planning Child Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More